Comment dated Friday, Nov 21, 2025: Pre-Dawn

Ultra Low Sulfur Diesel (USLD) fuel contracts of 42,000 gallons delivered to New York Harbor destinations have dropped from 5-month highs to one month lows in the last 3 sessions. The apparent reasons are a lower crude oil price due to excessive short-term supplies and easing production limits on OPEC members and suggestions of a possible Ukraine/Russia cease-fire.

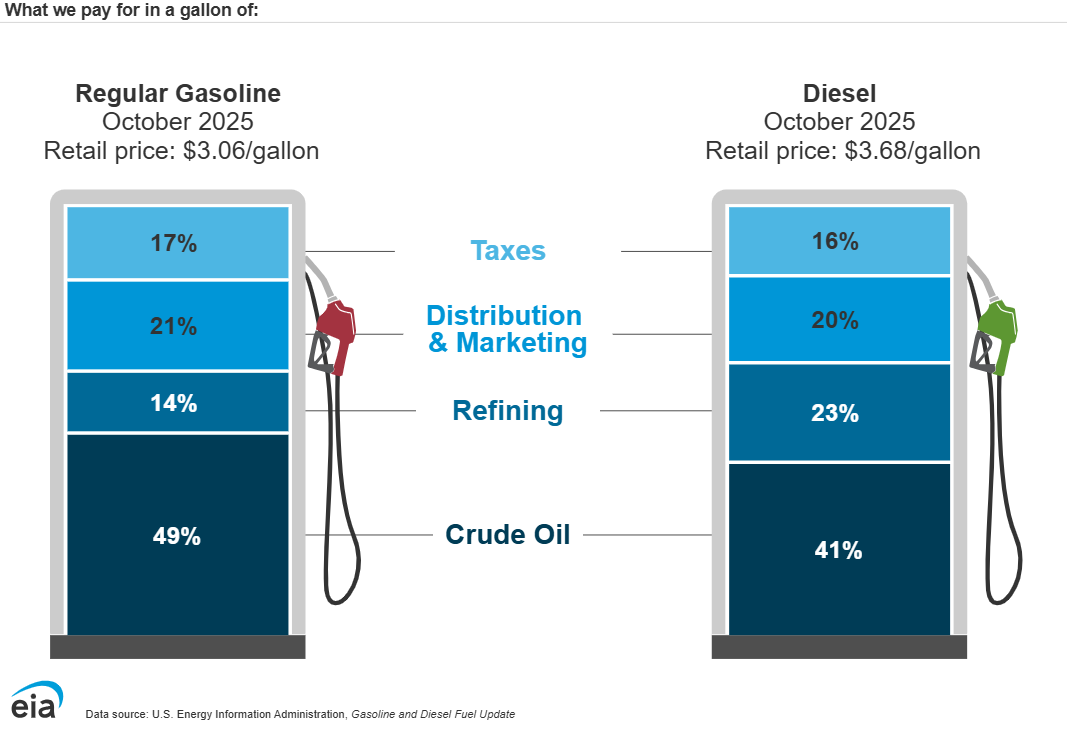

Crude oil is 50% of the diesel price, the balance is refining, transport, and taxes. As an economic canary similar to copper prices, another current implication of lower fuel prices is global economic slowing.

MarketBullets®

Click HERE to return to Bullets Base (non-annotated) Charts Courtesy of Genesis Trade Navigator.